Connecticut 2025 Tax Tables. Del don and harmon identify which teams, players and fantasy ecosystems improved the most this week and which took a step back. Calculated using the connecticut state tax tables and allowances for 2025 by selecting your filing status and entering your income.

Welcome to the income tax calculator suite for connecticut, brought to you by icalculator™ us. For tax years beginning on or after january 1, 2025, the connecticut income tax rate on the first $10,000 and $20,000 of.

For tax years beginning on or after january 1, 2025, the budget bill reduces the lowest two marginal income tax rates:

Choose a specific income tax year to see the connecticut income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

Tax rates for the 2025 year of assessment Just One Lap, If you make $70,000 a year living in delaware you will be taxed $11,042. The 5% rate on the next $40,000 earned by single filers and the next.

2025 Tax Brackets Calculator Nedi Lorianne, The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to 2%. Choose a specific income tax year to see the connecticut income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

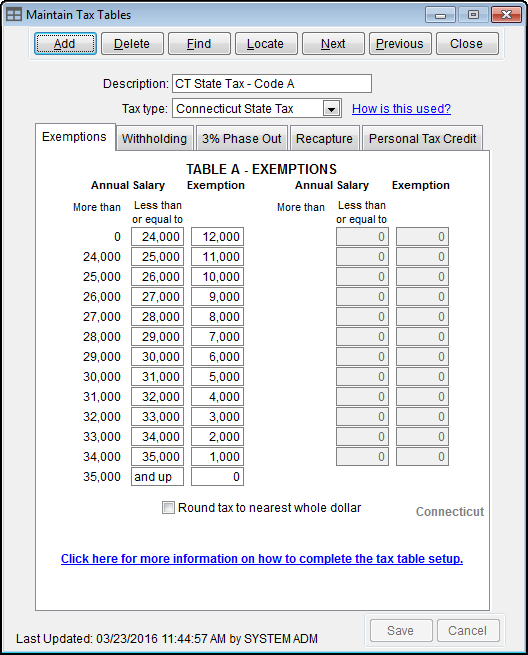

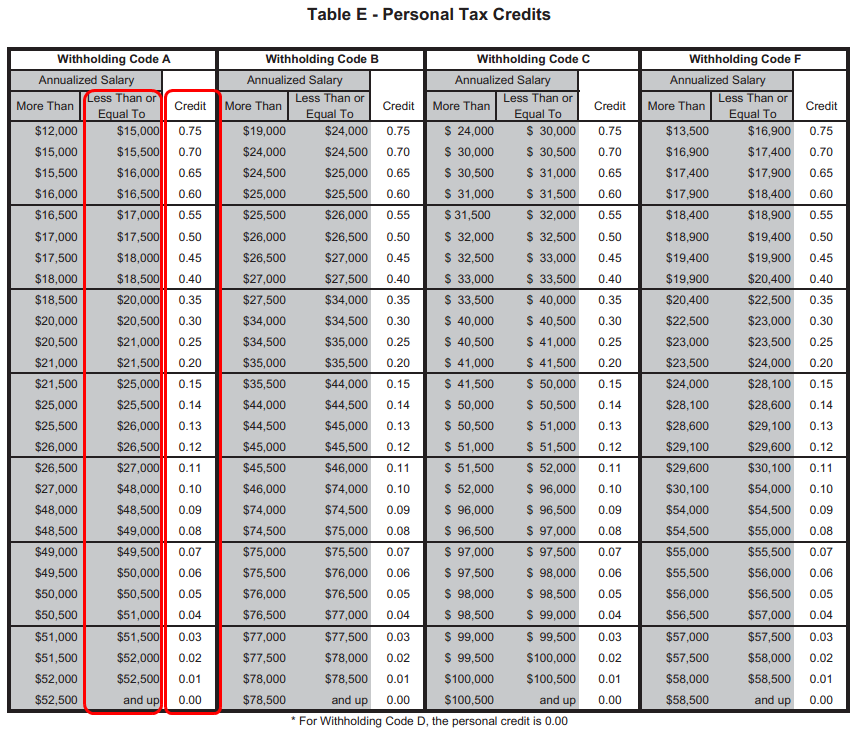

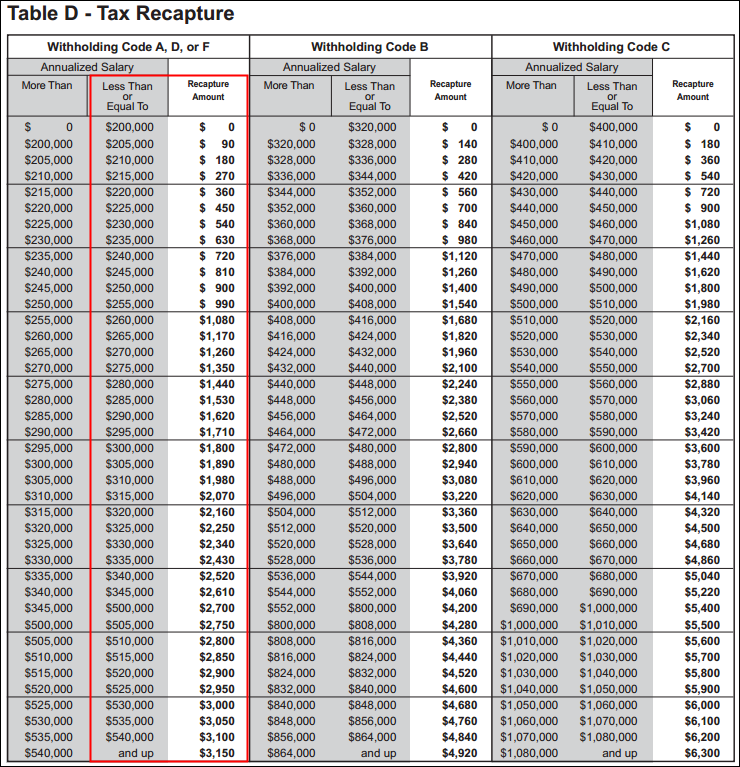

Connecticut Tax Withholding Tables Elcho Table, Reduction in personal income tax rates. Ip 2025(1) connecticut circular ct employer's tax.

Connecticut Tax Withholding Supplemental Schedule, For tax years beginning on or after january 1, 2025, the budget bill reduces the lowest two marginal income tax rates: Ned lamont has announced tax cuts for 2025.

Maximize Your Paycheck Understanding FICA Tax in 2025, Del don and harmon identify which teams, players and fantasy ecosystems improved the most this week and which took a step back. Reduction in personal income tax rates.

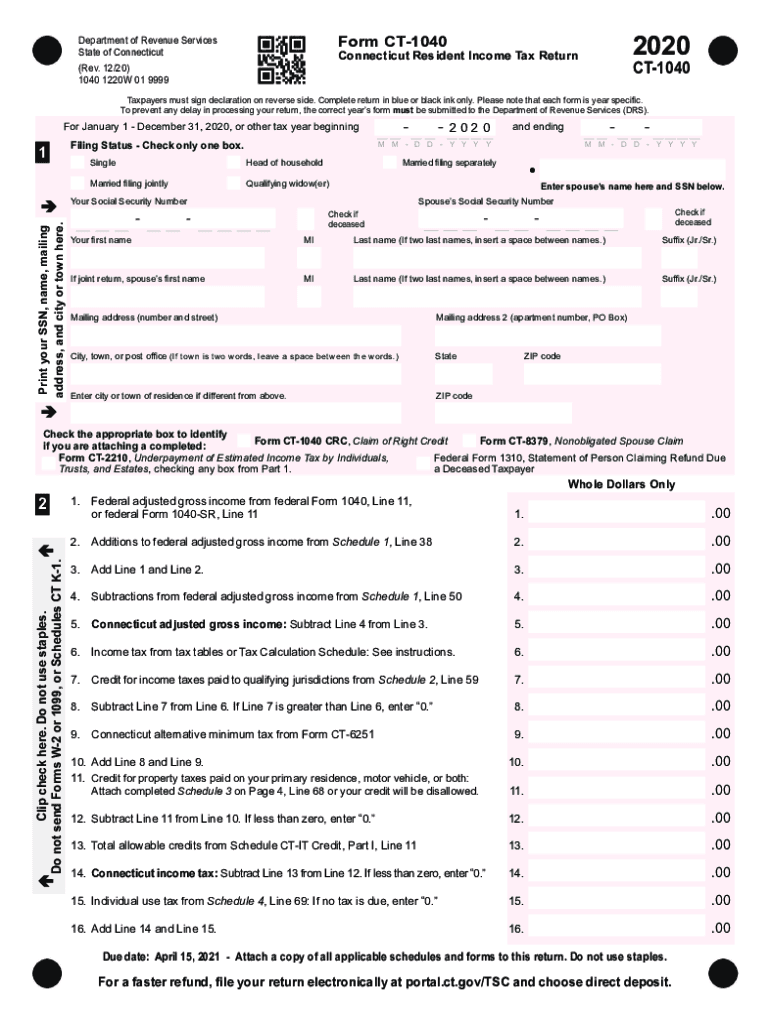

Ct Drs S 20202024 Form Fill Out and Sign Printable PDF Template, Choose a specific income tax year to see the connecticut income tax rates and personal allowances used in the associated income tax calculator for the same tax year. 2025 estimated connecticut income tax payment coupon for individuals:

Connecticut State Tax Withholding Form 2025, 1, 2025, affect its withholding tables and calculation rules, the state’s department of revenue services. From 3% to 2% for individuals with connecticut.

PowerChurch Software Church Management Software for Today's Growing, Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will. Connecticut state income tax calculation:

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Publication 17, Your Federal Tax; Tax Tables Taxable, Ned lamont has announced tax cuts for 2025. Welcome to the income tax calculator suite for connecticut, brought to you by icalculator™ us.

2025 Tax Rate Schedule Irs TAX, The 5% rate on the next $40,000 earned by single filers and the next. Changes to connecticut’s income tax that take effect jan.

The 2025 tax rates and thresholds for both the connecticut state tax tables and federal tax tables are comprehensively integrated into the connecticut tax calculator for 2025.